5 Types of Adjusting Entries

Accounting journal entries log transactions into accounting journal items and use debits abbreviated as Dr and credits abbreviated as Cr to. The revenue is recognized through an accrued revenue account and a receivable account.

Bookkeeping Adjusting Entries Reversing Entries Accountingcoach

An accrued revenue is the revenue that has been earned goods or services have been delivered while the cash has neither been received nor recorded.

. 5 Examples for Adjusting Entries. All three designations are central to agriculture. This entry type is posted to shift ending to retain the earning account from all temporary accounts like loss gain expense and revenue account Revenue Account Revenue accounts are those that report the businesss income and thus have credit balances.

Journal entries in a perpetual inventory system. Assume a two-month lease is entered and rent paid in advance on March 1 20X1 for 3000. The game takes place on a hard table divided by a net.

But any accounting student will have panicked every other time while equating the assets with liabilities and capital in preparation of the. Except for the initial serve the rules are generally as follows. There you have the first two types of adjusting entries that can be reversed.

When goods are purchased. A typical example is credit sales. Reversing Entries for Unearned Income and Prepaid Expense.

A closing entry is a journal entry done at the end of the accounting period. The equation Assets Liabilities Capital is referred to as the accounting equation. For the month of December this is the information.

In general there are two types of adjusting journal entries. When reconciling balance sheet accounts consider monthly adjusting entries relating to consolidation. Adjusting Entries Why Do We Need Adjusting Journal Entries.

Each month accountants make adjusting entries before publishing the final version of the monthly financial statements. Here we detail about the seven important types of journal entries used in accounting ie i Simple Entry ii Compound Entry iii Opening Entry iv Transfer Entries v Closing Entries vi Adjustment Entries and vii Rectifying Entries. Adjusting entries make sure that your financial statements only contain information relevant to the particular period of time youre interested in.

The set of journal entries involved starting from purchase to sale of goods under perpetual inventory system is given below. Table tennis also known as ping-pong and whiff-whaff is a sport in which two or four players hit a lightweight ball also known as the ping-pong ball back and forth across a table using small solid rackets. Players must allow a ball played toward them to bounce once on.

The second entry is pa 5 small canal The list then goes on and proceeds with a long enumeration of river names marked by the classifier ID 2. When expenses such as freight-in insurance etc. In part 2 well take a look at the other two types.

When the cash is received at a later time. It requires some time and a little effort for the concepts to sink in. Revenue from sales revenue.

Water for irrigation came from a river or major canal either to smaller canals pa 5 Akk. Such investigation can lead to the preparation of numerous adjusting entries. Adjusting entries are required at the end of each fiscal period to align the revenues and expenses to the right period in accord with the matching principle in accounting.

The five following entries are the most common although companies might have other adjusting entries such as allowances for doubtful accounts for example. Recording the interest. Now that we know the different types of adjusting entries lets check out how they are recorded into the accounting books.

In later chapters many additional examples will be described and analyzed. Illustration of Prepaid Rent. The post program selects unposted journal entries from the F0911 table posts them to the F0902 table and then updates the transaction in the F0911 table with the posted code P posted.

If you are having trouble understanding the process dont worry. When goods are sold to. The adjusting entry made at the end of the financial year allows the company to recognize interest expense that has occurred during the year and also adjust the liability of the company according to the interest expense.

The remaining 6000 amount would be transferred to expense over the next two years by preparing similar adjusting entries at the end of 20X2 and 20X3. Vanilla Bond Private limited company incorporated in the US has just started a brokerage business with equity capital of 15 million. For the sake of our example Company XYZ adjusts their accounts at the end of every month through the double-entry bookkeeping method.

3 Closing Entry. If you had ever been to business school having this equation proven in preparing financial statements would have been your dream. Intercompany transactions include adjusting entries for profit elimination relating to general ledger accounts like intercompany revenues accounts receivable fixed assets inventory accounts payable and cost of sales.

Operating Activities The company sold 500 units of merchandise at the price of 11000. Atappu or ditches eg. By March 31 20X1 half of the rental period has lapsed and financial statements are to be.

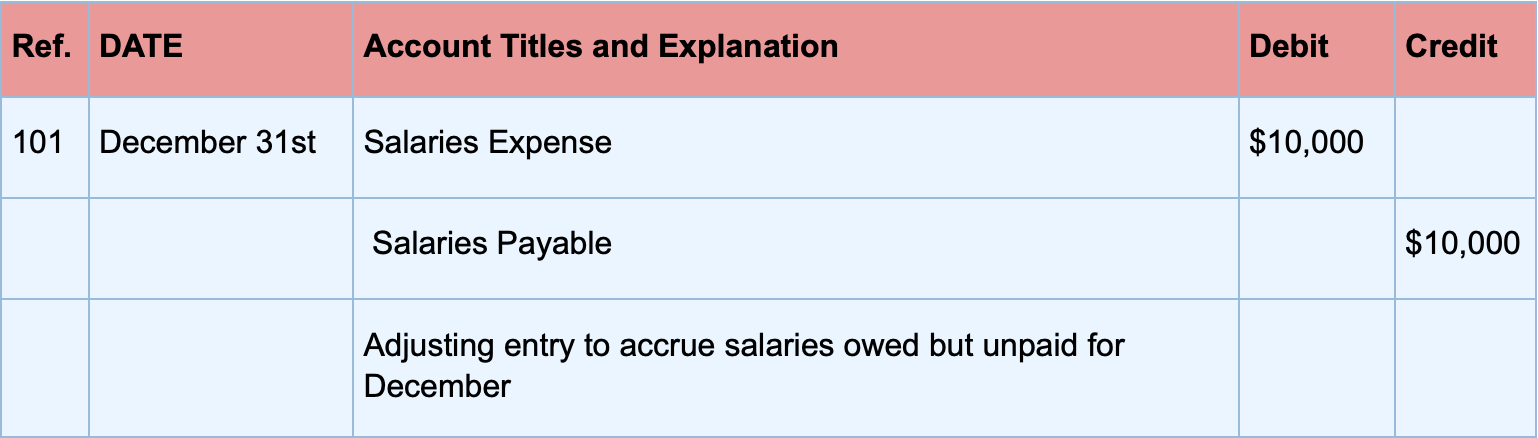

Customer paid 9000 in cash at the time of sale. This is because any unpaid interest is a liability for the company and must be recorded in the books. Salary Payable Example 1.

Types of Adjusting Journal Entries 1. There are four main types of adjustments. Deferrals accruals tax adjustments and missing transaction.

Here in Chapter 5 Why Must Financial Information Be Adjusted Prior to the Production of Financial Statements only the following four general types of adjustments are introduced. 1151 Understanding the Post Process for Journal Entries in a Foreign Currency After you enter review and approve foreign currency journal entries you post them to the general ledger. Examples of Salary Payable Journal Entries.

Once youve made the necessary correcting entries its time to make adjusting entries. When goods are returned to supplier. Simple entries are those entries in which only two accounts are affected one account is related to debit and another account.

The following are examples of salaries payable. 5 Types of Adjusting Entries. It has recently hired Regina as an accountant for the firm.

Adjusting Entries Definition Types Examples

Adjusting Entries Meaning Types Importance And More

6 Types Of Adjusting Entries Explanation With Example Tutor S Tips

No comments for "5 Types of Adjusting Entries"

Post a Comment